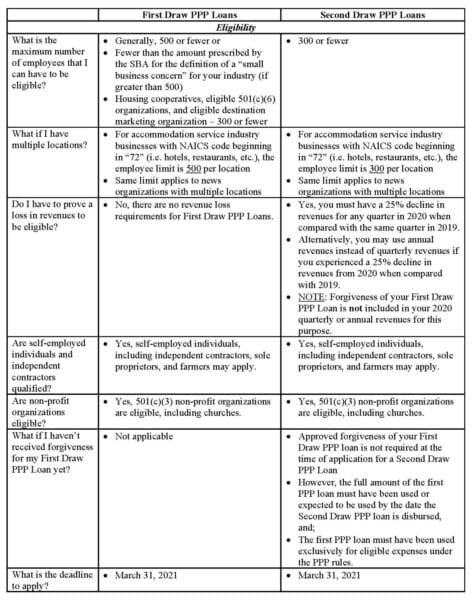

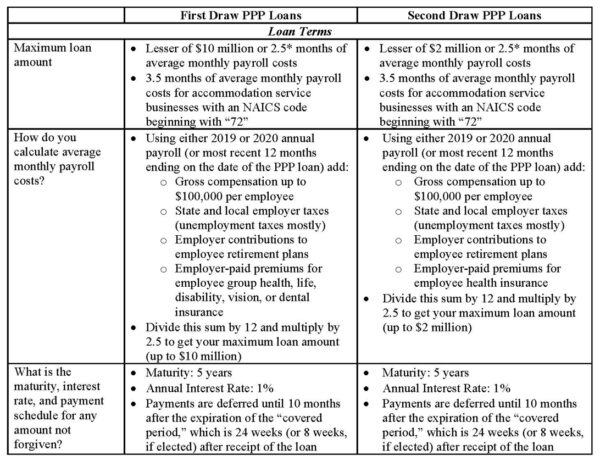

PPP Episode II: Return of the SBAJanuary 12, 2021Congress and the President said “Happy New Year,” in a way, to many small businesses continuing to be affected by the COVID-19 pandemic. The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (Economic Aid Act for short) was signed into law on December 27, 2020, and provided funding for an entirely new wave of funding for the Paycheck Protection Program (or PPP). The CARES Act in the spring of 2020 created forgivable loans issued by the Small Business Administration. The loans could be forgiven as long as they were used mostly for qualified payroll costs, as well as qualified business utilities, mortgage interest, and lease payments. Beyond that, the loan forgiveness is exempt from income taxes. Now, this same program has entirely new funding but also many new rules. This updated PPP loan program, popularly referred to as “PPP2,” can and should be analyzed almost as two separate programs: one for those businesses that did not previously receive a PPP loan and one for those businesses that did (referred to as First Draw PPP Loans and Second Draw PPP Loans, respectively). The below table represents a summary analysis of the PPP2 loan program for both First Draw and Second Draw PPP Loans. The main differences between First Draw and Second Draw PPP Loans are in the eligibility requirements and statutory maximum loan amounts. For both loan types, there are several new categories of eligible uses of PPP funds that a borrower could use to qualify for tax-free forgiveness.

As always, please let us know if you have any questions or concerns and we’d be happy to assist you and your business as we continue to navigate this pandemic. |

|